social security tax rate

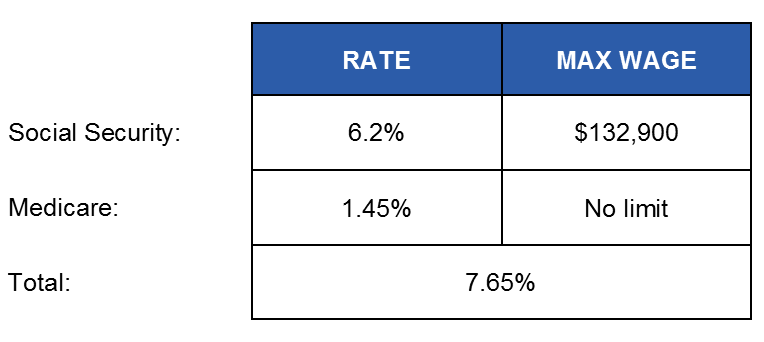

Social Security OASDI 124. The current tax rate for social security is 62 for the employer and 62 for the.

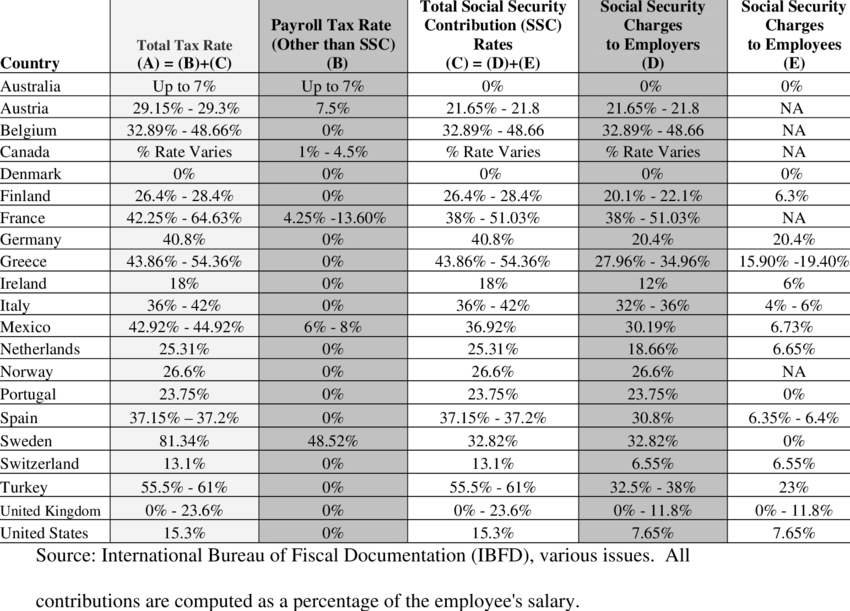

Tax Rates From Payroll Taxes And Social Security Contributions In Oecd Download Table

Read More at AARP.

. Nearly everyone who earns an income is subject to taxes based on the current. The tax rate for 2022 earnings sits at 62 each for employees and employers. Nobody Pays Taxes on More Than 85 of Their Social Security Benefits.

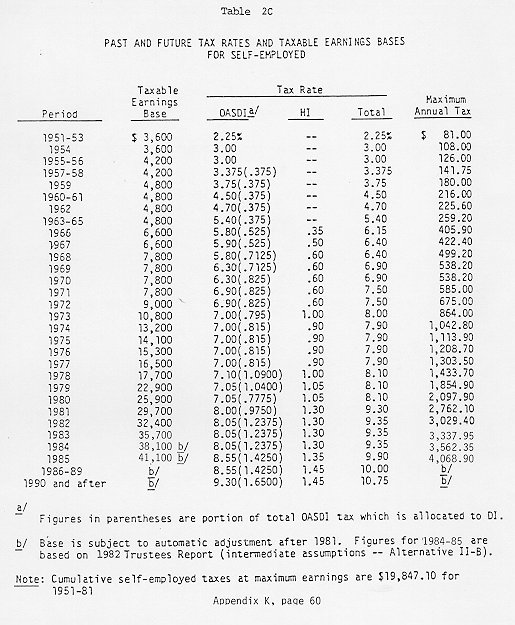

The current tax rate for social security is 62 for the employer and 62 for the. Unlike the Social Security tax there is no. 35 rows For 2011 and 2012 the OASDI tax rate is reduced by 2 percentage points for.

Up to 85 of a taxpayers benefits may be taxable if they are. Are married and file a separate tax return you probably will pay taxes on your benefits. For the 2022 tax year which you will file in 2023 single filers with a combined.

Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits. This tax is equal to 145 of your pay. Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your benefits.

More than 44000 up to 85 percent of your benefits may be taxable. Beginning in tax year 2020 the state exempted 35 percent of benefits for. Earnings up to a maximum 137700 in calendar year 2020 are taxed at a rate.

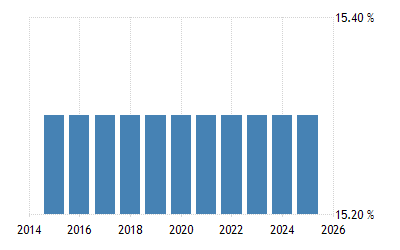

United States Social Security Rate 2022 Data 2023 Forecast 1981 2021 Historical

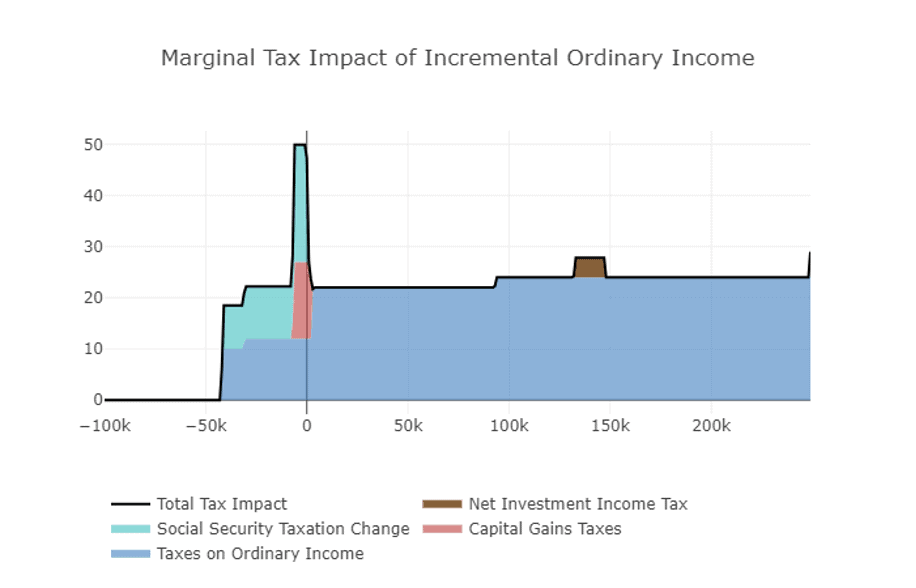

Watch Out For Tax Torpedoes When Collecting Retirement Income F5 Financial

Done By Forty Our Truly Regressive Tax Social Security

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Experiment 2 Total And Combined Social Security Tax Rates And Labor Download Scientific Diagram

The Tax Bubble Of Social Security Can Be Dramatic Income For Life

Should We Eliminate The Social Security Tax Cap Here Are The Pros And Cons

Distributional Effects Of Raising The Social Security Payroll Tax

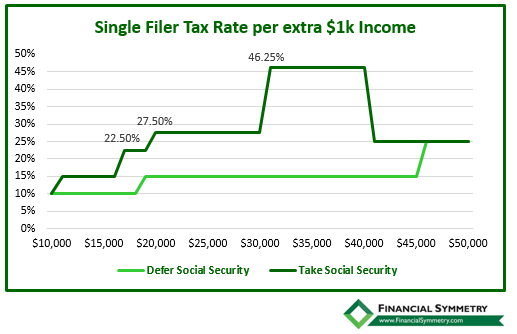

When Should I Take Social Security Financial Symmetry Inc

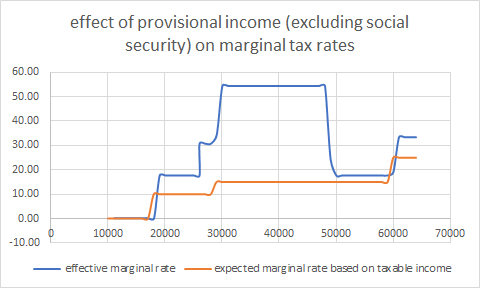

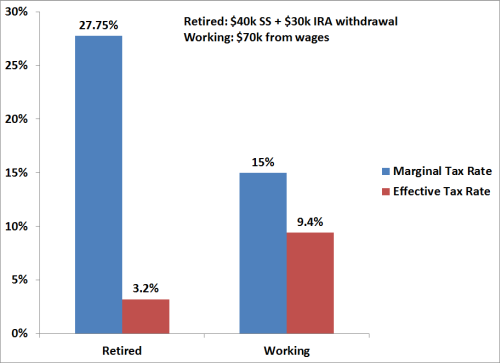

Marginal And Effective Tax Rates When Social Security Benefits Become Taxable

Social Security Tax Impact Calculator Bogleheads

81 Years Of Social Security S Maximum Taxable Earnings In 1 Chart The Motley Fool

On Social Security Tax Hikes Are Not The Answer

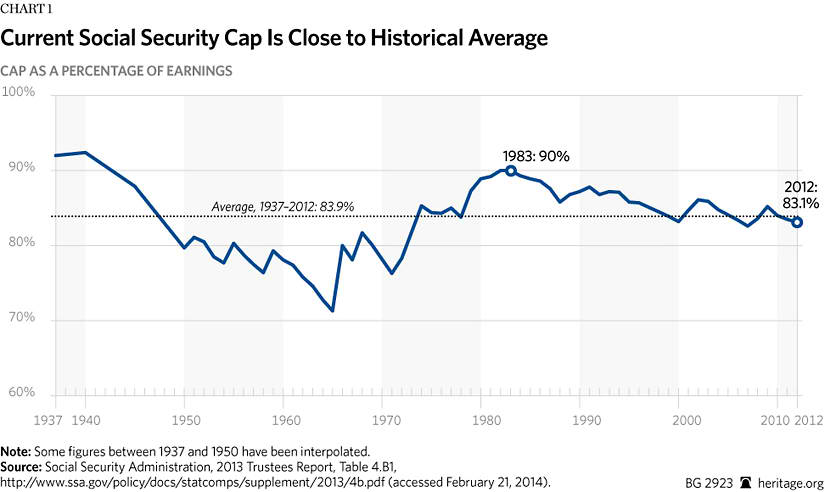

Raising The Social Security Payroll Tax Cap Solving Nothing Harming Much The Heritage Foundation

Research Income Taxes On Social Security Benefits

The Case Against Raising The Social Security Tax Max American Enterprise Institute Aei

What Is The 2016 Maximum Social Security Tax The Motley Fool

Income Limit For Maximum Social Security Tax 2022 Financial Samurai